## Stripe Payment Integration - Add Express.js backend server with Stripe Checkout Sessions - Create SQLite database for order tracking - Implement Stripe webhook handlers for payment events - Integrate with Wren Climate API for carbon offset fulfillment - Add CheckoutSuccess and CheckoutCancel pages - Create checkout API client for frontend - Update OffsetOrder component to redirect to Stripe Checkout - Add processing fee calculation (3% of base amount) - Implement order status tracking (pending → paid → fulfilled) Backend (server/): - Express server with CORS and middleware - SQLite database with Order schema - Stripe configuration and client - Order CRUD operations model - Checkout session creation endpoint - Webhook handler for payment confirmation - Wren API client for offset fulfillment Frontend: - CheckoutSuccess page with order details display - CheckoutCancel page with retry encouragement - Updated OffsetOrder to use Stripe checkout flow - Added checkout routes to App.tsx - TypeScript interfaces for checkout flow ## Visual & UX Enhancements - Add CertificationBadge component for project verification status - Create PortfolioDonutChart for visual portfolio allocation - Implement RadialProgress for percentage displays - Add reusable form components (FormInput, FormTextarea, FormSelect, FormFieldWrapper) - Refactor OffsetOrder with improved layout and animations - Add offset percentage slider with visual feedback - Enhance MobileOffsetOrder with better responsive design - Improve TripCalculator with cleaner UI structure - Update CurrencySelect with better styling - Add portfolio distribution visualization - Enhance project cards with hover effects and animations - Improve color palette and gradient usage throughout ## Configuration - Add VITE_API_BASE_URL environment variable - Create backend .env.example template - Update frontend .env.example with API URL - Add Stripe documentation references 🤖 Generated with [Claude Code](https://claude.com/claude-code) Co-Authored-By: Claude <noreply@anthropic.com>

573 KiB

Accept a payment

Securely accept payments online.

Build a payment form or use a prebuilt checkout page to start accepting online payments.

Stripe-hosted page

This is a Stripe-hosted page for when platform is web and ui is stripe-hosted. View the full page at https://docs.stripe.com/payments/accept-a-payment?platform=web&ui=stripe-hosted.

Redirect to a Stripe-hosted payment page using Stripe Checkout. See how this integration compares to Stripe’s other integration types.

Integration effort

Complexity: 2/5

Integration type

Redirect to Stripe-hosted payment page

UI customization

Limited customization

- 20 preset fonts

- 3 preset border radius

- Custom background and border color

- Custom logo

Use our official libraries to access the Stripe API from your application:

Ruby

# Available as a gem

sudo gem install stripe

# If you use bundler, you can add this line to your Gemfile

gem 'stripe'

Python

# Install through pip

pip3 install --upgrade stripe

# Or find the Stripe package on http://pypi.python.org/pypi/stripe/

# Find the version you want to pin:

# https://github.com/stripe/stripe-python/blob/master/CHANGELOG.md

# Specify that version in your requirements.txt file

stripe>=5.0.0

PHP

# Install the PHP library with Composer

composer require stripe/stripe-php

# Or download the source directly: https://github.com/stripe/stripe-php/releases

Java

/*

For Gradle, add the following dependency to your build.gradle and replace with

the version number you want to use from:

- https://mvnrepository.com/artifact/com.stripe/stripe-java or

- https://github.com/stripe/stripe-java/releases/latest

*/

implementation "com.stripe:stripe-java:30.0.0"

<!--

For Maven, add the following dependency to your POM and replace with the

version number you want to use from:

- https://mvnrepository.com/artifact/com.stripe/stripe-java or

- https://github.com/stripe/stripe-java/releases/latest

-->

<dependency>

<groupId>com.stripe</groupId>

<artifactId>stripe-java</artifactId>

<version>30.0.0</version>

</dependency>

# For other environments, manually install the following JARs:

# - The Stripe JAR from https://github.com/stripe/stripe-java/releases/latest

# - Google Gson from https://github.com/google/gson

Node.js

# Install with npm

npm install stripe --save

Go

# Make sure your project is using Go Modules

go mod init

# Install stripe-go

go get -u github.com/stripe/stripe-go/v83

// Then import the package

import (

"github.com/stripe/stripe-go/v83"

)

.NET

# Install with dotnet

dotnet add package Stripe.net

dotnet restore

# Or install with NuGet

Install-Package Stripe.net

Redirect your customer to Stripe Checkout [Client-side] [Server-side]

Add a checkout button to your website that calls a server-side endpoint to create a Checkout Session.

You can also create a Checkout Session for an existing customer, allowing you to prefill Checkout fields with known contact information and unify your purchase history for that customer.

<html>

<head>

<title>Buy cool new product</title>

</head>

<body>

<!-- Use action="/create-checkout-session.php" if your server is PHP based. -->

<form action="/create-checkout-session" method="POST">

<button type="submit">Checkout</button>

</form>

</body>

</html>

A Checkout Session is the programmatic representation of what your customer sees when they’re redirected to the payment form. You can configure it with options such as:

- Line items to charge

- Currencies to use

You must populate success_url with the URL value of a page on your website that Checkout returns your customer to after they complete the payment. You can optionally also provide a cancel_url value of a page on your website that Checkout returns your customer to if they terminate the payment process before completion.

Checkout Sessions expire 24 hours after creation by default.

After creating a Checkout Session, redirect your customer to the URL returned in the response.

Ruby

# This example sets up an endpoint using the Sinatra framework.

require 'json'

require 'sinatra'

require 'stripe'

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

Stripe.api_key = '<<YOUR_SECRET_KEY>>'

post '/create-checkout-session' dosession = Stripe::Checkout::Session.create({

line_items: [{

price_data: {

currency: 'usd',

product_data: {

name: 'T-shirt',

},

unit_amount: 2000,

},

quantity: 1,

}],

mode: 'payment',

# These placeholder URLs will be replaced in a following step.

success_url: 'https://example.com/success',

cancel_url: 'https://example.com/cancel',

})

redirect session.url, 303

end

Python

# This example sets up an endpoint using the Flask framework.

# Watch this video to get started: https://youtu.be/7Ul1vfmsDck.

import os

import stripe

from flask import Flask, redirect

app = Flask(__name__)

stripe.api_key = '<<YOUR_SECRET_KEY>>'

@app.route('/create-checkout-session', methods=['POST'])

def create_checkout_session():session = stripe.checkout.Session.create(

line_items=[{

'price_data': {

'currency': 'usd',

'product_data': {

'name': 'T-shirt',

},

'unit_amount': 2000,

},

'quantity': 1,

}],

mode='payment',

success_url='http://localhost:4242/success',

cancel_url='http://localhost:4242/cancel',

)

return redirect(session.url, code=303)

if __name__== '__main__':

app.run(port=4242)

PHP

<?php

require 'vendor/autoload.php';

$stripe = new \Stripe\StripeClient('<<YOUR_SECRET_KEY>>');

$checkout_session = $stripe->checkout->sessions->create([

'line_items' => [[

'price_data' => [

'currency' => 'usd',

'product_data' => [

'name' => 'T-shirt',

],

'unit_amount' => 2000,

],

'quantity' => 1,

]],

'mode' => 'payment',

'success_url' => 'http://localhost:4242/success',

'cancel_url' => 'http://localhost:4242/cancel',

]);

header("HTTP/1.1 303 See Other");

header("Location: " . $checkout_session->url);

?>

Java

import java.util.HashMap;

import java.util.Map;

import static spark.Spark.get;

import static spark.Spark.post;

import static spark.Spark.port;

import static spark.Spark.staticFiles;

import com.stripe.Stripe;

import com.stripe.model.checkout.Session;

import com.stripe.param.checkout.SessionCreateParams;

public class Server {

public static void main(String[] args) {

port(4242);

Stripe.apiKey = "<<YOUR_SECRET_KEY>>";

post("/create-checkout-session", (request, response) -> {SessionCreateParams params =

SessionCreateParams.builder()

.setMode(SessionCreateParams.Mode.PAYMENT)

.setSuccessUrl("http://localhost:4242/success")

.setCancelUrl("http://localhost:4242/cancel")

.addLineItem(

SessionCreateParams.LineItem.builder()

.setQuantity(1L)

.setPriceData(

SessionCreateParams.LineItem.PriceData.builder()

.setCurrency("usd")

.setUnitAmount(2000L)

.setProductData(

SessionCreateParams.LineItem.PriceData.ProductData.builder()

.setName("T-shirt")

.build())

.build())

.build())

.build();

Session session = Session.create(params);

response.redirect(session.getUrl(), 303);

return "";

});

}

}

Node.js

// This example sets up an endpoint using the Express framework.

const express = require('express');

const app = express();

const stripe = require('stripe')('<<YOUR_SECRET_KEY>>')

app.post('/create-checkout-session', async (req, res) => {const session = await stripe.checkout.sessions.create({

line_items: [

{

price_data: {

currency: 'usd',

product_data: {

name: 'T-shirt',

},

unit_amount: 2000,

},

quantity: 1,

},

],

mode: 'payment',

success_url: 'http://localhost:4242/success',

cancel_url: 'http://localhost:4242/cancel',

});

res.redirect(303, session.url);

});

app.listen(4242, () => console.log(`Listening on port ${4242}!`));

Go

package main

import (

"net/http"

"github.com/labstack/echo"

"github.com/labstack/echo/middleware"

"github.com/stripe/stripe-go/v76.0.0"

"github.com/stripe/stripe-go/v76.0.0/checkout/session"

)

// This example sets up an endpoint using the Echo framework.

// Watch this video to get started: https://youtu.be/ePmEVBu8w6Y.

func main() {

stripe.Key = "<<YOUR_SECRET_KEY>>"

e := echo.New()

e.Use(middleware.Logger())

e.Use(middleware.Recover())

e.POST("/create-checkout-session", createCheckoutSession)

e.Logger.Fatal(e.Start("localhost:4242"))

}

func createCheckoutSession(c echo.Context) (err error) {params := &stripe.CheckoutSessionParams{

Mode: stripe.String(string(stripe.CheckoutSessionModePayment)),

LineItems: []*stripe.CheckoutSessionLineItemParams{

&stripe.CheckoutSessionLineItemParams{

PriceData: &stripe.CheckoutSessionLineItemPriceDataParams{

Currency: stripe.String("usd"),

ProductData: &stripe.CheckoutSessionLineItemPriceDataProductDataParams{

Name: stripe.String("T-shirt"),

},

UnitAmount: stripe.Int64(2000),

},

Quantity: stripe.Int64(1),

},

},

SuccessURL: stripe.String("http://localhost:4242/success"),

CancelURL: stripe.String("http://localhost:4242/cancel"),

}

s, _ := session.New(params)

if err != nil {

return err

}

return c.Redirect(http.StatusSeeOther, s.URL)

}

.NET

// This example sets up an endpoint using the ASP.NET MVC framework.

// Watch this video to get started: https://youtu.be/2-mMOB8MhmE.

using System.Collections.Generic;

using Microsoft.AspNetCore.Mvc;

using Microsoft.Extensions.Options;

using Stripe;

using Stripe.Checkout;

namespace server.Controllers

{

public class PaymentsController : Controller

{

public PaymentsController()

{

StripeConfiguration.ApiKey = "<<YOUR_SECRET_KEY>>";

}

[HttpPost("create-checkout-session")]

public ActionResult CreateCheckoutSession()

{var options = new SessionCreateOptions

{

LineItems = new List<SessionLineItemOptions>

{

new SessionLineItemOptions

{

PriceData = new SessionLineItemPriceDataOptions

{

UnitAmount = 2000,

Currency = "usd",

ProductData = new SessionLineItemPriceDataProductDataOptions

{

Name = "T-shirt",

},

},

Quantity = 1,

},

},

Mode = "payment",

SuccessUrl = "http://localhost:4242/success",

CancelUrl = "http://localhost:4242/cancel",

};

var service = new SessionService();

Session session = service.Create(options);

Response.Headers.Add("Location", session.Url);

return new StatusCodeResult(303);

}

}

}

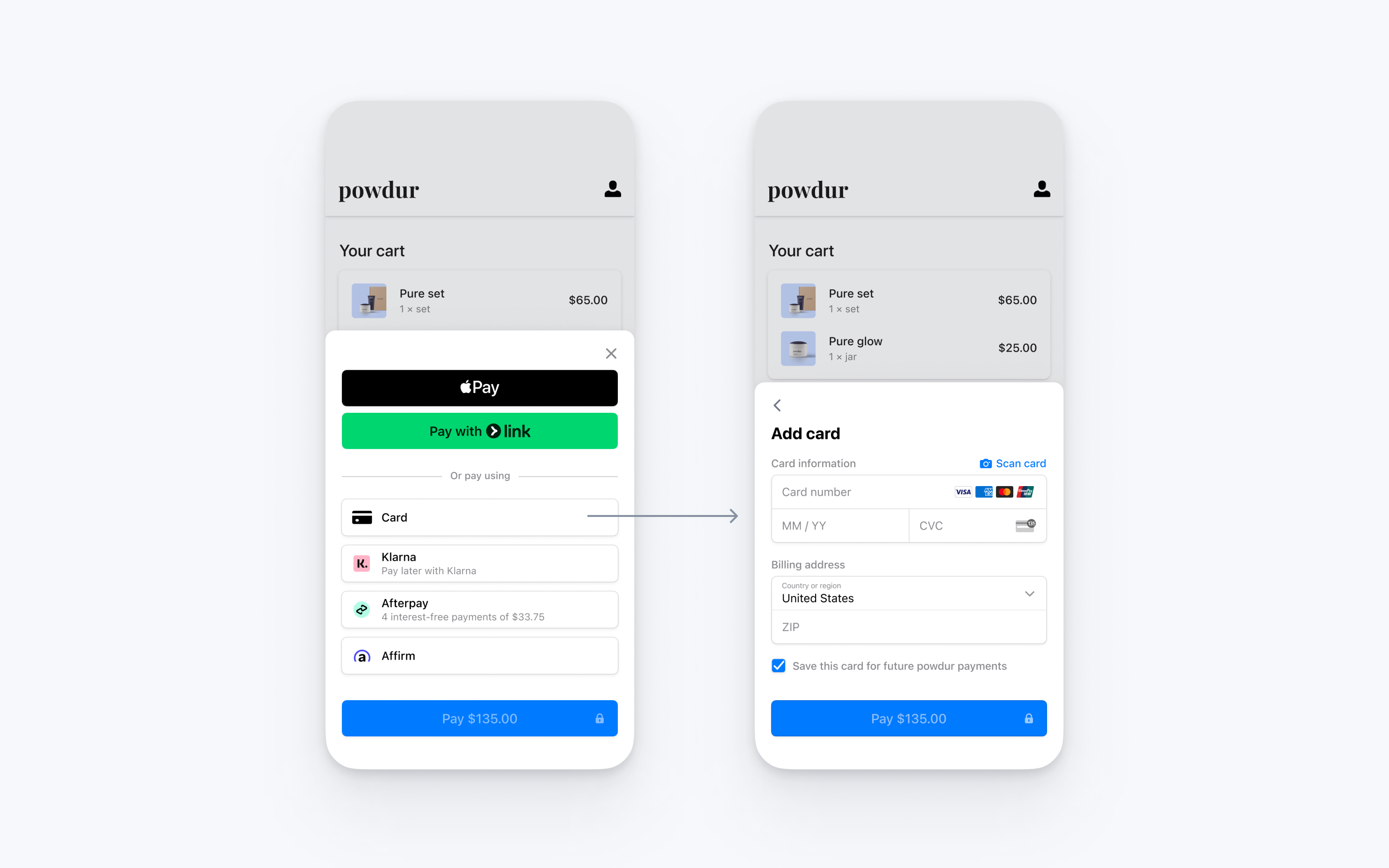

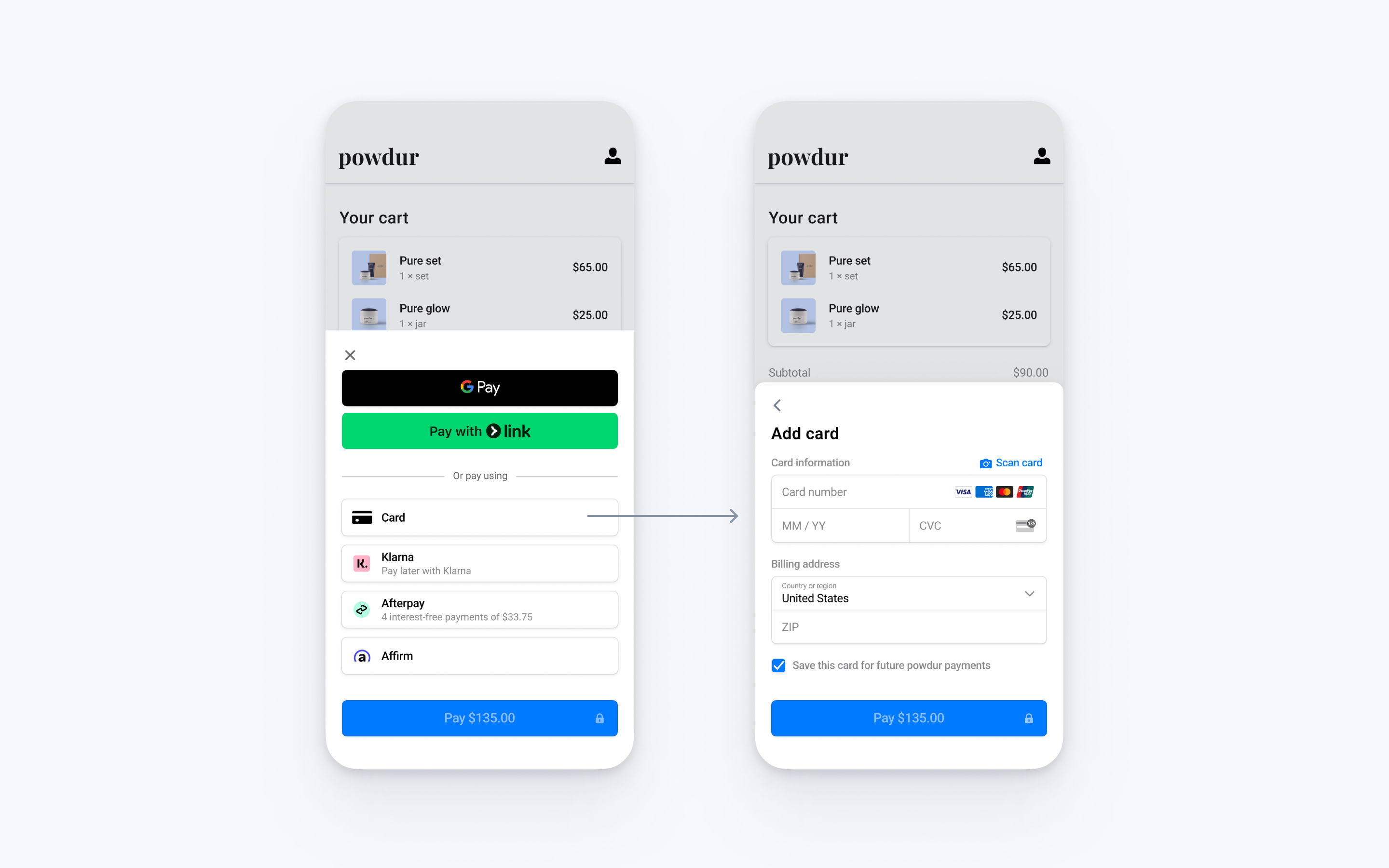

Payment methods

By default, Stripe enables cards and other common payment methods. You can turn individual payment methods on or off in the Stripe Dashboard. In Checkout, Stripe evaluates the currency and any restrictions, then dynamically presents the supported payment methods to the customer.

To see how your payment methods appear to customers, enter a transaction ID or set an order amount and currency in the Dashboard.

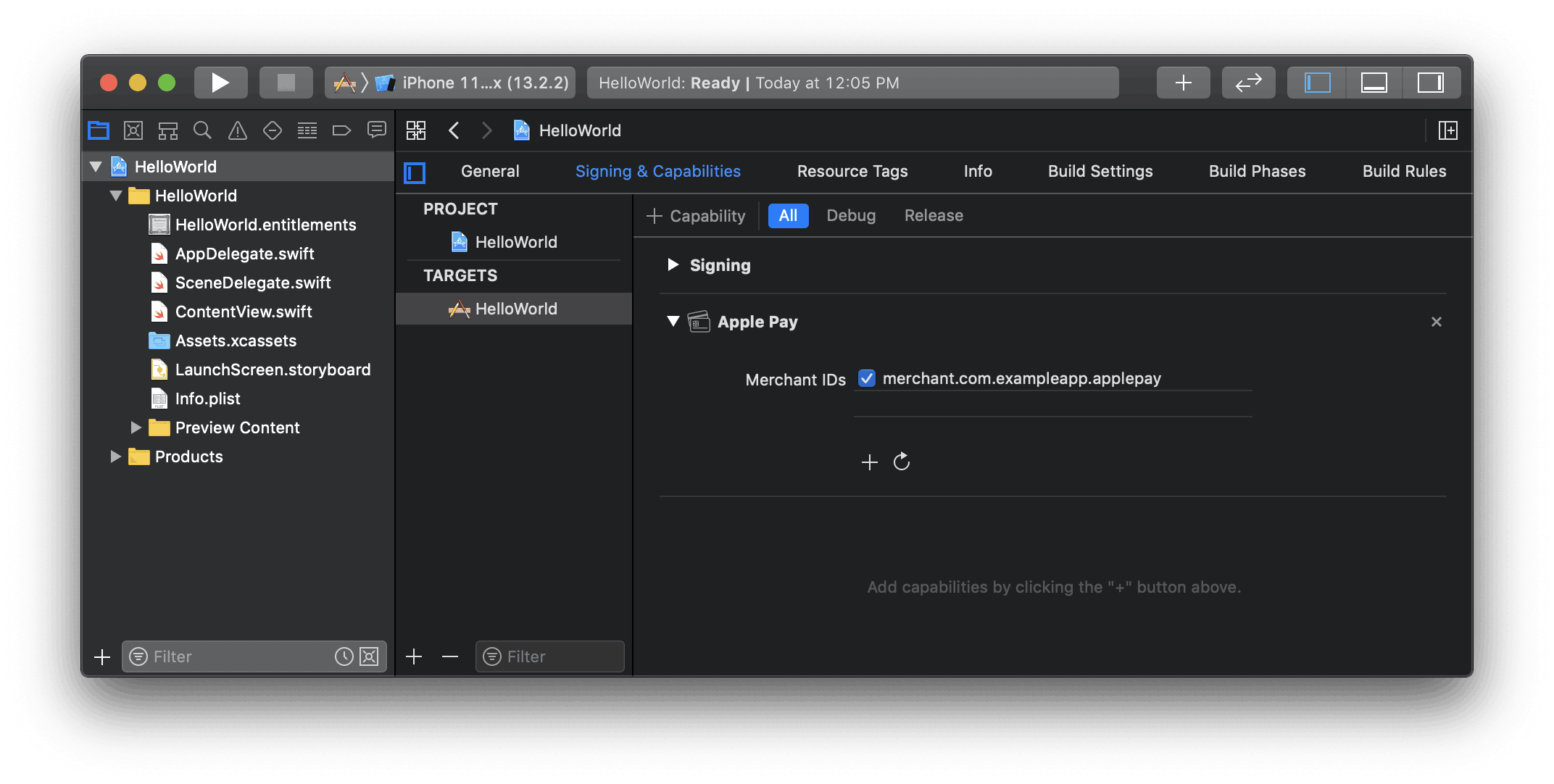

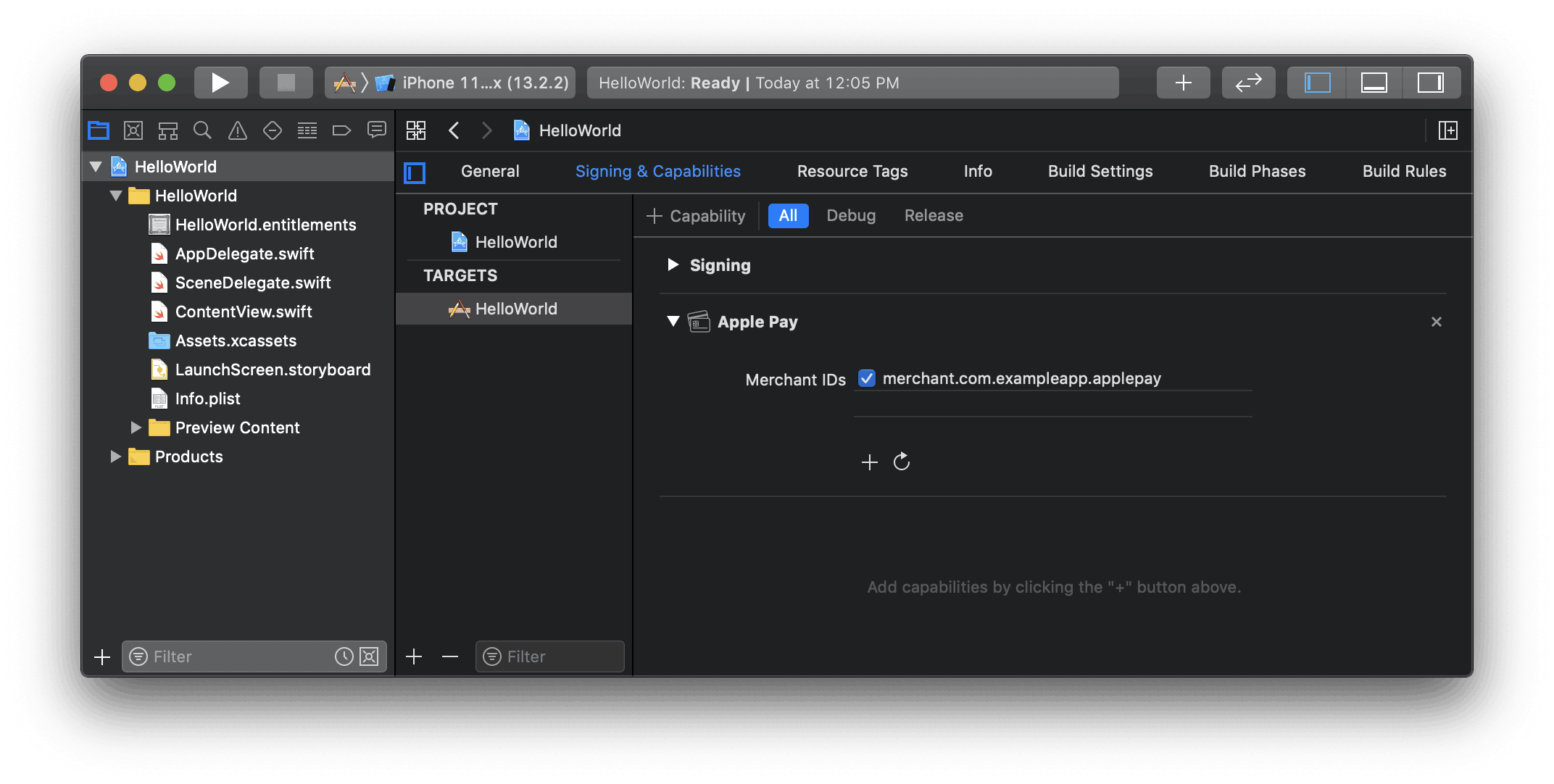

You can enable Apple Pay and Google Pay in your payment methods settings. By default, Apple Pay is enabled and Google Pay is disabled. However, in some cases Stripe filters them out even when they’re enabled. We filter Google Pay if you enable automatic tax without collecting a shipping address.

Checkout’s Stripe-hosted pages don’t need integration changes to enable Apple Pay or Google Pay. Stripe handles these payments the same way as other card payments.

Confirm your endpoint

Confirm your endpoint is accessible by starting your web server (for example, localhost:4242) and running the following command:

curl -X POST -is "http://localhost:4242/create-checkout-session" -d ""

You should see a response in your terminal that looks like this:

HTTP/1.1 303 See Other

Location: https://checkout.stripe.com/c/pay/cs_test_...

...

Testing

You should now have a working checkout button that redirects your customer to Stripe Checkout.

- Click the checkout button.

- You’re redirected to the Stripe Checkout payment form.

If your integration isn’t working:

- Open the Network tab in your browser’s developer tools.

- Click the checkout button and confirm it sent an XHR request to your server-side endpoint (

POST /create-checkout-session). - Verify the request is returning a 200 status.

- Use

console.log(session)inside your button click listener to confirm the correct data returned.

Show a success page [Client-side] [Server-side]

It’s important for your customer to see a success page after they successfully submit the payment form. Host this success page on your site.

Create a minimal success page:

<html>

<head><title>Thanks for your order!</title></head>

<body>

<h1>Thanks for your order!</h1>

<p>

We appreciate your business!

If you have any questions, please email

<a href="mailto:orders@example.com">orders@example.com</a>.

</p>

</body>

</html>

Next, update the Checkout Session creation endpoint to use this new page:

curl https://api.stripe.com/v1/checkout/sessions \

-u "<<YOUR_SECRET_KEY>>:" \

-d "line_items[0][price_data][currency]"=usd \

-d "line_items[0][price_data][product_data][name]"=T-shirt \

-d "line_items[0][price_data][unit_amount]"=2000 \

-d "line_items[0][quantity]"=1 \

-d mode=payment \

--data-urlencode success_url="http://localhost:4242/success.html" \

--data-urlencode cancel_url="http://localhost:4242/cancel.html"

stripe checkout sessions create \

-d "line_items[0][price_data][currency]"=usd \

-d "line_items[0][price_data][product_data][name]"=T-shirt \

-d "line_items[0][price_data][unit_amount]"=2000 \

-d "line_items[0][quantity]"=1 \

--mode=payment \

--success-url="http://localhost:4242/success.html" \

--cancel-url="http://localhost:4242/cancel.html"

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

client = Stripe::StripeClient.new("<<YOUR_SECRET_KEY>>")

session = client.v1.checkout.sessions.create({

line_items: [

{

price_data: {

currency: 'usd',

product_data: {name: 'T-shirt'},

unit_amount: 2000,

},

quantity: 1,

},

],

mode: 'payment',

success_url: 'http://localhost:4242/success.html',

cancel_url: 'http://localhost:4242/cancel.html',

})

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

client = StripeClient("<<YOUR_SECRET_KEY>>")

# For SDK versions 12.4.0 or lower, remove '.v1' from the following line.

session = client.v1.checkout.sessions.create({

"line_items": [

{

"price_data": {

"currency": "usd",

"product_data": {"name": "T-shirt"},

"unit_amount": 2000,

},

"quantity": 1,

},

],

"mode": "payment",

"success_url": "http://localhost:4242/success.html",

"cancel_url": "http://localhost:4242/cancel.html",

})

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

$stripe = new \Stripe\StripeClient('<<YOUR_SECRET_KEY>>');

$session = $stripe->checkout->sessions->create([

'line_items' => [

[

'price_data' => [

'currency' => 'usd',

'product_data' => ['name' => 'T-shirt'],

'unit_amount' => 2000,

],

'quantity' => 1,

],

],

'mode' => 'payment',

'success_url' => 'http://localhost:4242/success.html',

'cancel_url' => 'http://localhost:4242/cancel.html',

]);

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

StripeClient client = new StripeClient("<<YOUR_SECRET_KEY>>");

SessionCreateParams params =

SessionCreateParams.builder()

.addLineItem(

SessionCreateParams.LineItem.builder()

.setPriceData(

SessionCreateParams.LineItem.PriceData.builder()

.setCurrency("usd")

.setProductData(

SessionCreateParams.LineItem.PriceData.ProductData.builder()

.setName("T-shirt")

.build()

)

.setUnitAmount(2000L)

.build()

)

.setQuantity(1L)

.build()

)

.setMode(SessionCreateParams.Mode.PAYMENT)

.setSuccessUrl("http://localhost:4242/success.html")

.setCancelUrl("http://localhost:4242/cancel.html")

.build();

// For SDK versions 29.4.0 or lower, remove '.v1()' from the following line.

Session session = client.v1().checkout().sessions().create(params);

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

const stripe = require('stripe')('<<YOUR_SECRET_KEY>>');

const session = await stripe.checkout.sessions.create({

line_items: [

{

price_data: {

currency: 'usd',

product_data: {

name: 'T-shirt',

},

unit_amount: 2000,

},

quantity: 1,

},

],

mode: 'payment',

success_url: 'http://localhost:4242/success.html',

cancel_url: 'http://localhost:4242/cancel.html',

});

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

sc := stripe.NewClient("<<YOUR_SECRET_KEY>>")

params := &stripe.CheckoutSessionCreateParams{

LineItems: []*stripe.CheckoutSessionCreateLineItemParams{

&stripe.CheckoutSessionCreateLineItemParams{

PriceData: &stripe.CheckoutSessionCreateLineItemPriceDataParams{

Currency: stripe.String(stripe.CurrencyUSD),

ProductData: &stripe.CheckoutSessionCreateLineItemPriceDataProductDataParams{

Name: stripe.String("T-shirt"),

},

UnitAmount: stripe.Int64(2000),

},

Quantity: stripe.Int64(1),

},

},

Mode: stripe.String(stripe.CheckoutSessionModePayment),

SuccessURL: stripe.String("http://localhost:4242/success.html"),

CancelURL: stripe.String("http://localhost:4242/cancel.html"),

}

result, err := sc.V1CheckoutSessions.Create(context.TODO(), params)

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

var options = new Stripe.Checkout.SessionCreateOptions

{

LineItems = new List<Stripe.Checkout.SessionLineItemOptions>

{

new Stripe.Checkout.SessionLineItemOptions

{

PriceData = new Stripe.Checkout.SessionLineItemPriceDataOptions

{

Currency = "usd",

ProductData = new Stripe.Checkout.SessionLineItemPriceDataProductDataOptions

{

Name = "T-shirt",

},

UnitAmount = 2000,

},

Quantity = 1,

},

},

Mode = "payment",

SuccessUrl = "http://localhost:4242/success.html",

CancelUrl = "http://localhost:4242/cancel.html",

};

var client = new StripeClient("<<YOUR_SECRET_KEY>>");

var service = client.V1.Checkout.Sessions;

Stripe.Checkout.Session session = service.Create(options);

If you want to customize your success page, read the custom success page guide.

Testing

- Click your checkout button.

- Fill out the payment details with the test card information:

- Enter

4242 4242 4242 4242as the card number. - Enter any future date for card expiry.

- Enter any 3-digit number for CVC.

- Enter any billing postal code.

- Enter

- Click Pay.

- You’re redirected to your new success page.

Next, find the new payment in the Stripe Dashboard. Successful payments appear in the Dashboard’s list of payments. When you click a payment, it takes you to the payment details page. The Checkout summary section contains billing information and the list of items purchased, which you can use to manually fulfill the order.

Handle post-payment events

Stripe sends a checkout.session.completed event when a customer completes a Checkout Session payment. Use the Dashboard webhook tool or follow the webhook guide to receive and handle these events, which might trigger you to:

- Send an order confirmation email to your customer.

- Log the sale in a database.

- Start a shipping workflow.

Listen for these events rather than waiting for your customer to be redirected back to your website. Triggering fulfillment only from your Checkout landing page is unreliable. Setting up your integration to listen for asynchronous events allows you to accept different types of payment methods with a single integration.

Learn more in our fulfillment guide for Checkout.

Handle the following events when collecting payments with the Checkout:

| Event | Description | Action |

|---|---|---|

| checkout.session.completed | Sent when a customer successfully completes a Checkout Session. | Send the customer an order confirmation and fulfill (Fulfillment is the process of providing the goods or services purchased by a customer, typically after payment is collected) their order. |

| checkout.session.async_payment_succeeded | Sent when a payment made with a delayed payment method, such as ACH direct debt, succeeds. | Send the customer an order confirmation and fulfill (Fulfillment is the process of providing the goods or services purchased by a customer, typically after payment is collected) their order. |

| checkout.session.async_payment_failed | Sent when a payment made with a delayed payment method, such as ACH direct debt, fails. | Notify the customer of the failure and bring them back on-session to attempt payment again. |

Test your integration

To test your Stripe-hosted payment form integration:

- Create a Checkout Session.

- Fill out the payment details with a method from the following table.

- Enter any future date for card expiry.

- Enter any 3-digit number for CVC.

- Enter any billing postal code.

- Click Pay. You’re redirected to your

success_url. - Go to the Dashboard and look for the payment on the Transactions page. If your payment succeeded, you’ll see it in that list.

- Click your payment to see more details, like a Checkout summary with billing information and the list of purchased items. You can use this information to fulfill the order.

Learn more about testing your integration.

Cards

| Card number | Scenario | How to test |

|---|---|---|

| 4242424242424242 | The card payment succeeds and doesn’t require authentication. | Fill out the credit card form using the credit card number with any expiration, CVC, and postal code. |

| 4000002500003155 | The card payment requires authentication (Strong Customer Authentication (SCA) is a regulatory requirement in effect as of September 14, 2019, that impacts many European online payments. It requires customers to use two-factor authentication like 3D Secure to verify their purchase). | Fill out the credit card form using the credit card number with any expiration, CVC, and postal code. |

| 4000000000009995 | The card is declined with a decline code like insufficient_funds. |

Fill out the credit card form using the credit card number with any expiration, CVC, and postal code. |

| 6205500000000000004 | The UnionPay card has a variable length of 13-19 digits. | Fill out the credit card form using the credit card number with any expiration, CVC, and postal code. |

Wallets

| Payment method | Scenario | How to test |

|---|---|---|

| Alipay | Your customer successfully pays with a redirect-based and immediate notification payment method. | Choose any redirect-based payment method, fill out the required details, and confirm the payment. Then click Complete test payment on the redirect page. |

Bank redirects

| Payment method | Scenario | How to test |

|---|---|---|

| BECS Direct Debit | Your customer successfully pays with BECS Direct Debit. | Fill out the form using the account number 900123456 and BSB 000000. The confirmed PaymentIntent initially transitions to processing, then transitions to the succeeded status 3 minutes later. |

| BECS Direct Debit | Your customer’s payment fails with an account_closed error code. |

Fill out the form using the account number 111111113 and BSB 000000. |

| Bancontact, EPS, iDEAL, and Przelewy24 | Your customer fails to authenticate on the redirect page for a redirect-based and immediate notification payment method. | Choose any redirect-based payment method, fill out the required details, and confirm the payment. Then click Fail test payment on the redirect page. |

| Pay by Bank | Your customer successfully pays with a redirect-based and delayed notification payment method. | Choose the payment method, fill out the required details, and confirm the payment. Then click Complete test payment on the redirect page. |

| Pay by Bank | Your customer fails to authenticate on the redirect page for a redirect-based and delayed notification payment method. | Choose the payment method, fill out the required details, and confirm the payment. Then click Fail test payment on the redirect page. |

| BLIK | BLIK payments fail in a variety of ways—immediate failures (for example, the code is expired or invalid), delayed errors (the bank declines) or timeouts (the customer didn’t respond in time). | Use email patterns to simulate the different failures. |

Bank debits

| Payment method | Scenario | How to test |

|---|---|---|

| SEPA Direct Debit | Your customer successfully pays with SEPA Direct Debit. | Fill out the form using the account number AT321904300235473204. The confirmed PaymentIntent initially transitions to processing, then transitions to the succeeded status three minutes later. |

| SEPA Direct Debit | Your customer’s payment intent status transitions from processing to requires_payment_method. |

Fill out the form using the account number AT861904300235473202. |

Vouchers

| Payment method | Scenario | How to test |

|---|---|---|

| Boleto, OXXO | Your customer pays with a Boleto or OXXO voucher. | Select Boleto or OXXO as the payment method and submit the payment. Close the dialog after it appears. |

See Testing for additional information to test your integration.

Test cards

| Number | Description |

|---|---|

| 4242 4242 4242 4242 | Succeeds and immediately processes the payment. |

| 4000 0000 0000 3220 | Requires 3D Secure 2 authentication for a successful payment. |

| 4000 0000 0000 9995 | Always fails with a decline code of insufficient_funds. |

Optional: Create products and prices

You can set up your Checkout Session to accept tips and donations, or sell pay-what-you-want products and services.

Before you create a Checkout Session, you can create Products (Products represent what your business sells—whether that's a good or a service) and Prices (Prices define how much and how often to charge for products. This includes how much the product costs, what currency to use, and the interval if the price is for subscriptions) upfront. Use products to represent different physical goods or levels of service, and Prices (Prices define how much and how often to charge for products. This includes how much the product costs, what currency to use, and the interval if the price is for subscriptions) to represent each product’s pricing.

For example, you can create a T-shirt as a product with a price of 20 USD. This allows you to update and add prices without needing to change the details of your underlying products. You can either create products and prices with the Stripe Dashboard or API. Learn more about how products and prices work.

API

The API only requires a name to create a Product. Checkout displays the product name, description, and images that you supply.

curl https://api.stripe.com/v1/products \

-u "<<YOUR_SECRET_KEY>>:" \

-d name=T-shirt

stripe products create \

--name=T-shirt

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

client = Stripe::StripeClient.new("<<YOUR_SECRET_KEY>>")

product = client.v1.products.create({name: 'T-shirt'})

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

client = StripeClient("<<YOUR_SECRET_KEY>>")

# For SDK versions 12.4.0 or lower, remove '.v1' from the following line.

product = client.v1.products.create({"name": "T-shirt"})

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

$stripe = new \Stripe\StripeClient('<<YOUR_SECRET_KEY>>');

$product = $stripe->products->create(['name' => 'T-shirt']);

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

StripeClient client = new StripeClient("<<YOUR_SECRET_KEY>>");

ProductCreateParams params = ProductCreateParams.builder().setName("T-shirt").build();

// For SDK versions 29.4.0 or lower, remove '.v1()' from the following line.

Product product = client.v1().products().create(params);

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

const stripe = require('stripe')('<<YOUR_SECRET_KEY>>');

const product = await stripe.products.create({

name: 'T-shirt',

});

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

sc := stripe.NewClient("<<YOUR_SECRET_KEY>>")

params := &stripe.ProductCreateParams{Name: stripe.String("T-shirt")}

result, err := sc.V1Products.Create(context.TODO(), params)

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

var options = new ProductCreateOptions { Name = "T-shirt" };

var client = new StripeClient("<<YOUR_SECRET_KEY>>");

var service = client.V1.Products;

Product product = service.Create(options);

Next, create a Price to define how much to charge for your product. This includes how much the product costs and what currency to use.

curl https://api.stripe.com/v1/prices \

-u "<<YOUR_SECRET_KEY>>:" \

-d product="{{PRODUCT_ID}}" \

-d unit_amount=2000 \

-d currency=usd

stripe prices create \

--product="{{PRODUCT_ID}}" \

--unit-amount=2000 \

--currency=usd

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

client = Stripe::StripeClient.new("<<YOUR_SECRET_KEY>>")

price = client.v1.prices.create({

product: '{{PRODUCT_ID}}',

unit_amount: 2000,

currency: 'usd',

})

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

client = StripeClient("<<YOUR_SECRET_KEY>>")

# For SDK versions 12.4.0 or lower, remove '.v1' from the following line.

price = client.v1.prices.create({

"product": "{{PRODUCT_ID}}",

"unit_amount": 2000,

"currency": "usd",

})

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

$stripe = new \Stripe\StripeClient('<<YOUR_SECRET_KEY>>');

$price = $stripe->prices->create([

'product' => '{{PRODUCT_ID}}',

'unit_amount' => 2000,

'currency' => 'usd',

]);

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

StripeClient client = new StripeClient("<<YOUR_SECRET_KEY>>");

PriceCreateParams params =

PriceCreateParams.builder()

.setProduct("{{PRODUCT_ID}}")

.setUnitAmount(2000L)

.setCurrency("usd")

.build();

// For SDK versions 29.4.0 or lower, remove '.v1()' from the following line.

Price price = client.v1().prices().create(params);

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

const stripe = require('stripe')('<<YOUR_SECRET_KEY>>');

const price = await stripe.prices.create({

product: '{{PRODUCT_ID}}',

unit_amount: 2000,

currency: 'usd',

});

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

sc := stripe.NewClient("<<YOUR_SECRET_KEY>>")

params := &stripe.PriceCreateParams{

Product: stripe.String("{{PRODUCT_ID}}"),

UnitAmount: stripe.Int64(2000),

Currency: stripe.String(stripe.CurrencyUSD),

}

result, err := sc.V1Prices.Create(context.TODO(), params)

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

var options = new PriceCreateOptions

{

Product = "{{PRODUCT_ID}}",

UnitAmount = 2000,

Currency = "usd",

};

var client = new StripeClient("<<YOUR_SECRET_KEY>>");

var service = client.V1.Prices;

Price price = service.Create(options);

Dashboard

Copy products created in a sandbox to live mode so that you don’t need to re-create them. In the Product detail view in the Dashboard, click Copy to live mode in the upper right corner. You can only do this once for each product created in a sandbox. Subsequent updates to the test product aren’t reflected for the live product.

Make sure you’re in a sandbox by clicking Sandboxes within the Dashboard account picker. Next, define the items you want to sell. To create a new product and price:

- Navigate to the Products section in the Dashboard.

- Click Add product.

- Select One time when setting the price.

Checkout displays the product name, description, and images that you supply.

Each price you create has an ID. When you create a Checkout Session, reference the price ID and quantity. If you’re selling in multiple currencies, make your Price multi-currency (A single Price object can support multiple currencies. Each purchase uses one of the supported currencies for the Price, depending on how you use the Price in your integration). Checkout automatically determines the customer’s local currency and presents that currency if the Price supports it.

curl https://api.stripe.com/v1/checkout/sessions \

-u "<<YOUR_SECRET_KEY>>:" \

-d mode=payment \

-d "line_items[0][price]"={{PRICE_ID}} \

-d "line_items[0][quantity]"=1 \

--data-urlencode success_url="https://example.com/success?session_id={CHECKOUT_SESSION_ID}" \

--data-urlencode cancel_url="https://example.com/cancel"

stripe checkout sessions create \

--mode=payment \

-d "line_items[0][price]"={{PRICE_ID}} \

-d "line_items[0][quantity]"=1 \

--success-url="https://example.com/success?session_id={CHECKOUT_SESSION_ID}" \

--cancel-url="https://example.com/cancel"

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

client = Stripe::StripeClient.new("<<YOUR_SECRET_KEY>>")

session = client.v1.checkout.sessions.create({

mode: 'payment',

line_items: [

{

price: '{{PRICE_ID}}',

quantity: 1,

},

],

success_url: 'https://example.com/success?session_id={CHECKOUT_SESSION_ID}',

cancel_url: 'https://example.com/cancel',

})

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

client = StripeClient("<<YOUR_SECRET_KEY>>")

# For SDK versions 12.4.0 or lower, remove '.v1' from the following line.

session = client.v1.checkout.sessions.create({

"mode": "payment",

"line_items": [{"price": "{{PRICE_ID}}", "quantity": 1}],

"success_url": "https://example.com/success?session_id={CHECKOUT_SESSION_ID}",

"cancel_url": "https://example.com/cancel",

})

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

$stripe = new \Stripe\StripeClient('<<YOUR_SECRET_KEY>>');

$session = $stripe->checkout->sessions->create([

'mode' => 'payment',

'line_items' => [

[

'price' => '{{PRICE_ID}}',

'quantity' => 1,

],

],

'success_url' => 'https://example.com/success?session_id={CHECKOUT_SESSION_ID}',

'cancel_url' => 'https://example.com/cancel',

]);

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

StripeClient client = new StripeClient("<<YOUR_SECRET_KEY>>");

SessionCreateParams params =

SessionCreateParams.builder()

.setMode(SessionCreateParams.Mode.PAYMENT)

.addLineItem(

SessionCreateParams.LineItem.builder()

.setPrice("{{PRICE_ID}}")

.setQuantity(1L)

.build()

)

.setSuccessUrl("https://example.com/success?session_id={CHECKOUT_SESSION_ID}")

.setCancelUrl("https://example.com/cancel")

.build();

// For SDK versions 29.4.0 or lower, remove '.v1()' from the following line.

Session session = client.v1().checkout().sessions().create(params);

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

const stripe = require('stripe')('<<YOUR_SECRET_KEY>>');

const session = await stripe.checkout.sessions.create({

mode: 'payment',

line_items: [

{

price: '{{PRICE_ID}}',

quantity: 1,

},

],

success_url: 'https://example.com/success?session_id={CHECKOUT_SESSION_ID}',

cancel_url: 'https://example.com/cancel',

});

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

sc := stripe.NewClient("<<YOUR_SECRET_KEY>>")

params := &stripe.CheckoutSessionCreateParams{

Mode: stripe.String(stripe.CheckoutSessionModePayment),

LineItems: []*stripe.CheckoutSessionCreateLineItemParams{

&stripe.CheckoutSessionCreateLineItemParams{

Price: stripe.String("{{PRICE_ID}}"),

Quantity: stripe.Int64(1),

},

},

SuccessURL: stripe.String("https://example.com/success?session_id={CHECKOUT_SESSION_ID}"),

CancelURL: stripe.String("https://example.com/cancel"),

}

result, err := sc.V1CheckoutSessions.Create(context.TODO(), params)

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

var options = new Stripe.Checkout.SessionCreateOptions

{

Mode = "payment",

LineItems = new List<Stripe.Checkout.SessionLineItemOptions>

{

new Stripe.Checkout.SessionLineItemOptions

{

Price = "{{PRICE_ID}}",

Quantity = 1,

},

},

SuccessUrl = "https://example.com/success?session_id={CHECKOUT_SESSION_ID}",

CancelUrl = "https://example.com/cancel",

};

var client = new StripeClient("<<YOUR_SECRET_KEY>>");

var service = client.V1.Checkout.Sessions;

Stripe.Checkout.Session session = service.Create(options);

Optional: Prefill customer data [Server-side]

If you’ve already collected your customer’s email and want to prefill it in the Checkout Session for them, pass customer_email when creating a Checkout Session.

curl https://api.stripe.com/v1/checkout/sessions \

-u "<<YOUR_SECRET_KEY>>:" \

--data-urlencode customer_email="customer@example.com" \

-d "line_items[0][price]"="{{PRICE_ID}}" \

-d "line_items[0][quantity]"=1 \

-d mode=payment \

--data-urlencode success_url="https://example.com/success" \

--data-urlencode cancel_url="https://example.com/cancel"

stripe checkout sessions create \

--customer-email="customer@example.com" \

-d "line_items[0][price]"="{{PRICE_ID}}" \

-d "line_items[0][quantity]"=1 \

--mode=payment \

--success-url="https://example.com/success" \

--cancel-url="https://example.com/cancel"

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

client = Stripe::StripeClient.new("<<YOUR_SECRET_KEY>>")

session = client.v1.checkout.sessions.create({

customer_email: 'customer@example.com',

line_items: [

{

price: '{{PRICE_ID}}',

quantity: 1,

},

],

mode: 'payment',

success_url: 'https://example.com/success',

cancel_url: 'https://example.com/cancel',

})

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

client = StripeClient("<<YOUR_SECRET_KEY>>")

# For SDK versions 12.4.0 or lower, remove '.v1' from the following line.

session = client.v1.checkout.sessions.create({

"customer_email": "customer@example.com",

"line_items": [{"price": "{{PRICE_ID}}", "quantity": 1}],

"mode": "payment",

"success_url": "https://example.com/success",

"cancel_url": "https://example.com/cancel",

})

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

$stripe = new \Stripe\StripeClient('<<YOUR_SECRET_KEY>>');

$session = $stripe->checkout->sessions->create([

'customer_email' => 'customer@example.com',

'line_items' => [

[

'price' => '{{PRICE_ID}}',

'quantity' => 1,

],

],

'mode' => 'payment',

'success_url' => 'https://example.com/success',

'cancel_url' => 'https://example.com/cancel',

]);

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

StripeClient client = new StripeClient("<<YOUR_SECRET_KEY>>");

SessionCreateParams params =

SessionCreateParams.builder()

.setCustomerEmail("customer@example.com")

.addLineItem(

SessionCreateParams.LineItem.builder()

.setPrice("{{PRICE_ID}}")

.setQuantity(1L)

.build()

)

.setMode(SessionCreateParams.Mode.PAYMENT)

.setSuccessUrl("https://example.com/success")

.setCancelUrl("https://example.com/cancel")

.build();

// For SDK versions 29.4.0 or lower, remove '.v1()' from the following line.

Session session = client.v1().checkout().sessions().create(params);

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

const stripe = require('stripe')('<<YOUR_SECRET_KEY>>');

const session = await stripe.checkout.sessions.create({

customer_email: 'customer@example.com',

line_items: [

{

price: '{{PRICE_ID}}',

quantity: 1,

},

],

mode: 'payment',

success_url: 'https://example.com/success',

cancel_url: 'https://example.com/cancel',

});

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

sc := stripe.NewClient("<<YOUR_SECRET_KEY>>")

params := &stripe.CheckoutSessionCreateParams{

CustomerEmail: stripe.String("customer@example.com"),

LineItems: []*stripe.CheckoutSessionCreateLineItemParams{

&stripe.CheckoutSessionCreateLineItemParams{

Price: stripe.String("{{PRICE_ID}}"),

Quantity: stripe.Int64(1),

},

},

Mode: stripe.String(stripe.CheckoutSessionModePayment),

SuccessURL: stripe.String("https://example.com/success"),

CancelURL: stripe.String("https://example.com/cancel"),

}

result, err := sc.V1CheckoutSessions.Create(context.TODO(), params)

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

var options = new Stripe.Checkout.SessionCreateOptions

{

CustomerEmail = "customer@example.com",

LineItems = new List<Stripe.Checkout.SessionLineItemOptions>

{

new Stripe.Checkout.SessionLineItemOptions

{

Price = "{{PRICE_ID}}",

Quantity = 1,

},

},

Mode = "payment",

SuccessUrl = "https://example.com/success",

CancelUrl = "https://example.com/cancel",

};

var client = new StripeClient("<<YOUR_SECRET_KEY>>");

var service = client.V1.Checkout.Sessions;

Stripe.Checkout.Session session = service.Create(options);

Optional: Save payment method details [Server-side]

By default, payment methods used to make a one-time payment with Checkout aren’t available for future use.

Save payment methods to charge them off-session

You can set Checkout to save payment methods used to make a one-time payment by passing the payment_intent_data.setup_future_usage argument. This is useful if you need to capture a payment method on-file to use for future fees, such as cancellation or no-show fees.

curl https://api.stripe.com/v1/checkout/sessions \

-u "<<YOUR_SECRET_KEY>>:" \

-d customer_creation=always \

-d "line_items[0][price_data][currency]"=usd \

-d "line_items[0][price_data][product_data][name]"=T-shirt \

-d "line_items[0][price_data][unit_amount]"=2000 \

-d "line_items[0][quantity]"=1 \

-d mode=payment \

--data-urlencode success_url="https://example.com/success.html" \

--data-urlencode cancel_url="https://example.com/cancel.html" \

-d "payment_intent_data[setup_future_usage]"=off_session

stripe checkout sessions create \

--customer-creation=always \

-d "line_items[0][price_data][currency]"=usd \

-d "line_items[0][price_data][product_data][name]"=T-shirt \

-d "line_items[0][price_data][unit_amount]"=2000 \

-d "line_items[0][quantity]"=1 \

--mode=payment \

--success-url="https://example.com/success.html" \

--cancel-url="https://example.com/cancel.html" \

-d "payment_intent_data[setup_future_usage]"=off_session

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

client = Stripe::StripeClient.new("<<YOUR_SECRET_KEY>>")

session = client.v1.checkout.sessions.create({

customer_creation: 'always',

line_items: [

{

price_data: {

currency: 'usd',

product_data: {name: 'T-shirt'},

unit_amount: 2000,

},

quantity: 1,

},

],

mode: 'payment',

success_url: 'https://example.com/success.html',

cancel_url: 'https://example.com/cancel.html',

payment_intent_data: {setup_future_usage: 'off_session'},

})

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

client = StripeClient("<<YOUR_SECRET_KEY>>")

# For SDK versions 12.4.0 or lower, remove '.v1' from the following line.

session = client.v1.checkout.sessions.create({

"customer_creation": "always",

"line_items": [

{

"price_data": {

"currency": "usd",

"product_data": {"name": "T-shirt"},

"unit_amount": 2000,

},

"quantity": 1,

},

],

"mode": "payment",

"success_url": "https://example.com/success.html",

"cancel_url": "https://example.com/cancel.html",

"payment_intent_data": {"setup_future_usage": "off_session"},

})

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

$stripe = new \Stripe\StripeClient('<<YOUR_SECRET_KEY>>');

$session = $stripe->checkout->sessions->create([

'customer_creation' => 'always',

'line_items' => [

[

'price_data' => [

'currency' => 'usd',

'product_data' => ['name' => 'T-shirt'],

'unit_amount' => 2000,

],

'quantity' => 1,

],

],

'mode' => 'payment',

'success_url' => 'https://example.com/success.html',

'cancel_url' => 'https://example.com/cancel.html',

'payment_intent_data' => ['setup_future_usage' => 'off_session'],

]);

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

StripeClient client = new StripeClient("<<YOUR_SECRET_KEY>>");

SessionCreateParams params =

SessionCreateParams.builder()

.setCustomerCreation(SessionCreateParams.CustomerCreation.ALWAYS)

.addLineItem(

SessionCreateParams.LineItem.builder()

.setPriceData(

SessionCreateParams.LineItem.PriceData.builder()

.setCurrency("usd")

.setProductData(

SessionCreateParams.LineItem.PriceData.ProductData.builder()

.setName("T-shirt")

.build()

)

.setUnitAmount(2000L)

.build()

)

.setQuantity(1L)

.build()

)

.setMode(SessionCreateParams.Mode.PAYMENT)

.setSuccessUrl("https://example.com/success.html")

.setCancelUrl("https://example.com/cancel.html")

.setPaymentIntentData(

SessionCreateParams.PaymentIntentData.builder()

.setSetupFutureUsage(

SessionCreateParams.PaymentIntentData.SetupFutureUsage.OFF_SESSION

)

.build()

)

.build();

// For SDK versions 29.4.0 or lower, remove '.v1()' from the following line.

Session session = client.v1().checkout().sessions().create(params);

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

const stripe = require('stripe')('<<YOUR_SECRET_KEY>>');

const session = await stripe.checkout.sessions.create({

customer_creation: 'always',

line_items: [

{

price_data: {

currency: 'usd',

product_data: {

name: 'T-shirt',

},

unit_amount: 2000,

},

quantity: 1,

},

],

mode: 'payment',

success_url: 'https://example.com/success.html',

cancel_url: 'https://example.com/cancel.html',

payment_intent_data: {

setup_future_usage: 'off_session',

},

});

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

sc := stripe.NewClient("<<YOUR_SECRET_KEY>>")

params := &stripe.CheckoutSessionCreateParams{

CustomerCreation: stripe.String(stripe.CheckoutSessionCustomerCreationAlways),

LineItems: []*stripe.CheckoutSessionCreateLineItemParams{

&stripe.CheckoutSessionCreateLineItemParams{

PriceData: &stripe.CheckoutSessionCreateLineItemPriceDataParams{

Currency: stripe.String(stripe.CurrencyUSD),

ProductData: &stripe.CheckoutSessionCreateLineItemPriceDataProductDataParams{

Name: stripe.String("T-shirt"),

},

UnitAmount: stripe.Int64(2000),

},

Quantity: stripe.Int64(1),

},

},

Mode: stripe.String(stripe.CheckoutSessionModePayment),

SuccessURL: stripe.String("https://example.com/success.html"),

CancelURL: stripe.String("https://example.com/cancel.html"),

PaymentIntentData: &stripe.CheckoutSessionCreatePaymentIntentDataParams{

SetupFutureUsage: stripe.String("off_session"),

},

}

result, err := sc.V1CheckoutSessions.Create(context.TODO(), params)

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

var options = new Stripe.Checkout.SessionCreateOptions

{

CustomerCreation = "always",

LineItems = new List<Stripe.Checkout.SessionLineItemOptions>

{

new Stripe.Checkout.SessionLineItemOptions

{

PriceData = new Stripe.Checkout.SessionLineItemPriceDataOptions

{

Currency = "usd",

ProductData = new Stripe.Checkout.SessionLineItemPriceDataProductDataOptions

{

Name = "T-shirt",

},

UnitAmount = 2000,

},

Quantity = 1,

},

},

Mode = "payment",

SuccessUrl = "https://example.com/success.html",

CancelUrl = "https://example.com/cancel.html",

PaymentIntentData = new Stripe.Checkout.SessionPaymentIntentDataOptions

{

SetupFutureUsage = "off_session",

},

};

var client = new StripeClient("<<YOUR_SECRET_KEY>>");

var service = client.V1.Checkout.Sessions;

Stripe.Checkout.Session session = service.Create(options);

If you use Checkout in subscription mode, Stripe automatically saves the payment method to charge it for subsequent payments. Card payment methods saved to customers using either setup_future_usage or subscription mode don’t appear for return purchases in Checkout (more on this below). We recommend using custom text to link out to any relevant terms regarding the usage of saved payment information.

Global privacy laws are complicated and nuanced. We recommend contacting your legal and privacy team prior to implementing setup_future_usage because it might implicate your existing privacy compliance framework. Refer to the guidance issued by the European Protection Board to learn more about saving payment details.

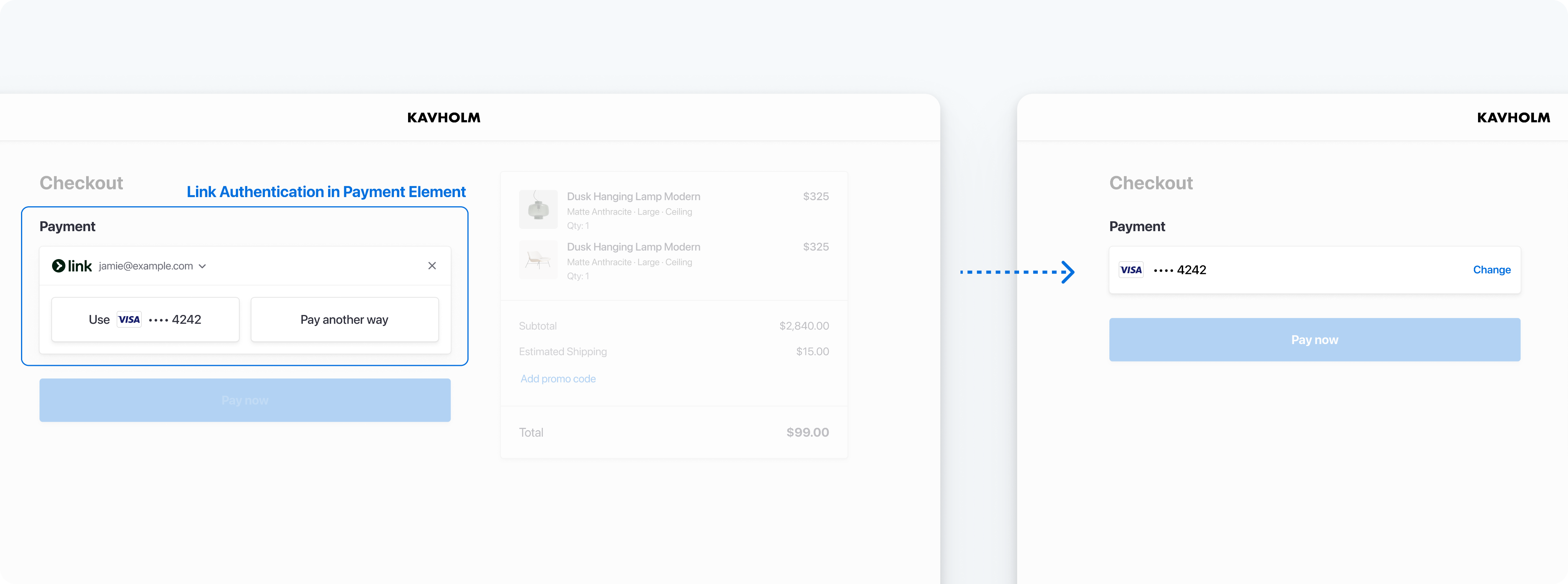

Save payment methods to prefill them in Checkout

By default, Checkout uses Link to provide your customers with the option to securely save and reuse their payment information. If you prefer to manage payment methods yourself, use saved_payment_method_options.payment_method_save when creating a Checkout Session to let your customers save their payment methods for future purchases in Checkout.

curl https://api.stripe.com/v1/checkout/sessions \

-u "<<YOUR_SECRET_KEY>>:" \

-d customer_creation=always \

-d "line_items[0][price_data][currency]"=usd \

-d "line_items[0][price_data][product_data][name]"=T-shirt \

-d "line_items[0][price_data][unit_amount]"=2000 \

-d "line_items[0][quantity]"=1 \

-d mode=payment \

--data-urlencode success_url="https://example.com/success.html" \

--data-urlencode cancel_url="https://example.com/cancel.html" \

-d "saved_payment_method_options[payment_method_save]"=enabled

stripe checkout sessions create \

--customer-creation=always \

-d "line_items[0][price_data][currency]"=usd \

-d "line_items[0][price_data][product_data][name]"=T-shirt \

-d "line_items[0][price_data][unit_amount]"=2000 \

-d "line_items[0][quantity]"=1 \

--mode=payment \

--success-url="https://example.com/success.html" \

--cancel-url="https://example.com/cancel.html" \

-d "saved_payment_method_options[payment_method_save]"=enabled

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

client = Stripe::StripeClient.new("<<YOUR_SECRET_KEY>>")

session = client.v1.checkout.sessions.create({

customer_creation: 'always',

line_items: [

{

price_data: {

currency: 'usd',

product_data: {name: 'T-shirt'},

unit_amount: 2000,

},

quantity: 1,

},

],

mode: 'payment',

success_url: 'https://example.com/success.html',

cancel_url: 'https://example.com/cancel.html',

saved_payment_method_options: {payment_method_save: 'enabled'},

})

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

client = StripeClient("<<YOUR_SECRET_KEY>>")

# For SDK versions 12.4.0 or lower, remove '.v1' from the following line.

session = client.v1.checkout.sessions.create({

"customer_creation": "always",

"line_items": [

{

"price_data": {

"currency": "usd",

"product_data": {"name": "T-shirt"},

"unit_amount": 2000,

},

"quantity": 1,

},

],

"mode": "payment",

"success_url": "https://example.com/success.html",

"cancel_url": "https://example.com/cancel.html",

"saved_payment_method_options": {"payment_method_save": "enabled"},

})

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

$stripe = new \Stripe\StripeClient('<<YOUR_SECRET_KEY>>');

$session = $stripe->checkout->sessions->create([

'customer_creation' => 'always',

'line_items' => [

[

'price_data' => [

'currency' => 'usd',

'product_data' => ['name' => 'T-shirt'],

'unit_amount' => 2000,

],

'quantity' => 1,

],

],

'mode' => 'payment',

'success_url' => 'https://example.com/success.html',

'cancel_url' => 'https://example.com/cancel.html',

'saved_payment_method_options' => ['payment_method_save' => 'enabled'],

]);

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

StripeClient client = new StripeClient("<<YOUR_SECRET_KEY>>");

SessionCreateParams params =

SessionCreateParams.builder()

.setCustomerCreation(SessionCreateParams.CustomerCreation.ALWAYS)

.addLineItem(

SessionCreateParams.LineItem.builder()

.setPriceData(

SessionCreateParams.LineItem.PriceData.builder()

.setCurrency("usd")

.setProductData(

SessionCreateParams.LineItem.PriceData.ProductData.builder()

.setName("T-shirt")

.build()

)

.setUnitAmount(2000L)

.build()

)

.setQuantity(1L)

.build()

)

.setMode(SessionCreateParams.Mode.PAYMENT)

.setSuccessUrl("https://example.com/success.html")

.setCancelUrl("https://example.com/cancel.html")

.setSavedPaymentMethodOptions(

SessionCreateParams.SavedPaymentMethodOptions.builder()

.setPaymentMethodSave(

SessionCreateParams.SavedPaymentMethodOptions.PaymentMethodSave.ENABLED

)

.build()

)

.build();

// For SDK versions 29.4.0 or lower, remove '.v1()' from the following line.

Session session = client.v1().checkout().sessions().create(params);

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

const stripe = require('stripe')('<<YOUR_SECRET_KEY>>');

const session = await stripe.checkout.sessions.create({

customer_creation: 'always',

line_items: [

{

price_data: {

currency: 'usd',

product_data: {

name: 'T-shirt',

},

unit_amount: 2000,

},

quantity: 1,

},

],

mode: 'payment',

success_url: 'https://example.com/success.html',

cancel_url: 'https://example.com/cancel.html',

saved_payment_method_options: {

payment_method_save: 'enabled',

},

});

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

sc := stripe.NewClient("<<YOUR_SECRET_KEY>>")

params := &stripe.CheckoutSessionCreateParams{

CustomerCreation: stripe.String(stripe.CheckoutSessionCustomerCreationAlways),

LineItems: []*stripe.CheckoutSessionCreateLineItemParams{

&stripe.CheckoutSessionCreateLineItemParams{

PriceData: &stripe.CheckoutSessionCreateLineItemPriceDataParams{

Currency: stripe.String(stripe.CurrencyUSD),

ProductData: &stripe.CheckoutSessionCreateLineItemPriceDataProductDataParams{

Name: stripe.String("T-shirt"),

},

UnitAmount: stripe.Int64(2000),

},

Quantity: stripe.Int64(1),

},

},

Mode: stripe.String(stripe.CheckoutSessionModePayment),

SuccessURL: stripe.String("https://example.com/success.html"),

CancelURL: stripe.String("https://example.com/cancel.html"),

SavedPaymentMethodOptions: &stripe.CheckoutSessionCreateSavedPaymentMethodOptionsParams{

PaymentMethodSave: stripe.String(stripe.CheckoutSessionSavedPaymentMethodOptionsPaymentMethodSaveEnabled),

},

}

result, err := sc.V1CheckoutSessions.Create(context.TODO(), params)

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

var options = new Stripe.Checkout.SessionCreateOptions

{

CustomerCreation = "always",

LineItems = new List<Stripe.Checkout.SessionLineItemOptions>

{

new Stripe.Checkout.SessionLineItemOptions

{

PriceData = new Stripe.Checkout.SessionLineItemPriceDataOptions

{

Currency = "usd",

ProductData = new Stripe.Checkout.SessionLineItemPriceDataProductDataOptions

{

Name = "T-shirt",

},

UnitAmount = 2000,

},

Quantity = 1,

},

},

Mode = "payment",

SuccessUrl = "https://example.com/success.html",

CancelUrl = "https://example.com/cancel.html",

SavedPaymentMethodOptions = new Stripe.Checkout.SessionSavedPaymentMethodOptionsOptions

{

PaymentMethodSave = "enabled",

},

};

var client = new StripeClient("<<YOUR_SECRET_KEY>>");

var service = client.V1.Checkout.Sessions;

Stripe.Checkout.Session session = service.Create(options);

Passing this parameter in either payment or subscription mode displays an optional checkbox to let customers explicitly save their payment method for future purchases. When customers check this checkbox, Checkout saves the payment method with allow_redisplay: always. Checkout uses this parameter to determine whether a payment method can be prefilled on future purchases. When using saved_payment_method_options.payment_method_save, you don’t need to pass in setup_future_usage to save the payment method.

Using saved_payment_method_options.payment_method_save requires a Customer. To save a new customer, set the Checkout Session’s customer_creation to always. Otherwise, the session doesn’t save the customer or the payment method.

If payment_method_save isn’t passed in or if the customer doesn’t agree to save the payment method, Checkout still saves payment methods created in subscription mode or using setup_future_usage. These payment methods have an allow_redisplay value of limited, which prevents them from being prefilled for returning purchases and allows you to comply with card network rules and data protection regulations. Learn how to change the default behavior enabled by these modes and how to change or override allow_redisplay behavior.

You can use Checkout to save cards and other payment methods to charge them off-session, but Checkout only prefills saved cards. Learn how to prefill saved cards. To save a payment method without an initial payment, use Checkout in setup mode.

Let customers remove saved payment methods

To let your customers remove a saved payment method so it doesn’t resurface for future payments, use saved_payment_method_options.payment_method_remove when creating a Checkout Session.

curl https://api.stripe.com/v1/checkout/sessions \

-u "<<YOUR_SECRET_KEY>>:" \

-d customer={{CUSTOMER_ID}} \

-d "line_items[0][price_data][currency]"=usd \

-d "line_items[0][price_data][product_data][name]"=T-shirt \

-d "line_items[0][price_data][unit_amount]"=2000 \

-d "line_items[0][quantity]"=1 \

-d mode=payment \

--data-urlencode success_url="https://example.com/success.html" \

--data-urlencode cancel_url="https://example.com/cancel.html" \

-d "saved_payment_method_options[payment_method_remove]"=enabled

stripe checkout sessions create \

--customer={{CUSTOMER_ID}} \

-d "line_items[0][price_data][currency]"=usd \

-d "line_items[0][price_data][product_data][name]"=T-shirt \

-d "line_items[0][price_data][unit_amount]"=2000 \

-d "line_items[0][quantity]"=1 \

--mode=payment \

--success-url="https://example.com/success.html" \

--cancel-url="https://example.com/cancel.html" \

-d "saved_payment_method_options[payment_method_remove]"=enabled

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

client = Stripe::StripeClient.new("<<YOUR_SECRET_KEY>>")

session = client.v1.checkout.sessions.create({

customer: '{{CUSTOMER_ID}}',

line_items: [

{

price_data: {

currency: 'usd',

product_data: {name: 'T-shirt'},

unit_amount: 2000,

},

quantity: 1,

},

],

mode: 'payment',

success_url: 'https://example.com/success.html',

cancel_url: 'https://example.com/cancel.html',

saved_payment_method_options: {payment_method_remove: 'enabled'},

})

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

client = StripeClient("<<YOUR_SECRET_KEY>>")

# For SDK versions 12.4.0 or lower, remove '.v1' from the following line.

session = client.v1.checkout.sessions.create({

"customer": "{{CUSTOMER_ID}}",

"line_items": [

{

"price_data": {

"currency": "usd",

"product_data": {"name": "T-shirt"},

"unit_amount": 2000,

},

"quantity": 1,

},

],

"mode": "payment",

"success_url": "https://example.com/success.html",

"cancel_url": "https://example.com/cancel.html",

"saved_payment_method_options": {"payment_method_remove": "enabled"},

})

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

$stripe = new \Stripe\StripeClient('<<YOUR_SECRET_KEY>>');

$session = $stripe->checkout->sessions->create([

'customer' => '{{CUSTOMER_ID}}',

'line_items' => [

[

'price_data' => [

'currency' => 'usd',

'product_data' => ['name' => 'T-shirt'],

'unit_amount' => 2000,

],

'quantity' => 1,

],

],

'mode' => 'payment',

'success_url' => 'https://example.com/success.html',

'cancel_url' => 'https://example.com/cancel.html',

'saved_payment_method_options' => ['payment_method_remove' => 'enabled'],

]);

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

StripeClient client = new StripeClient("<<YOUR_SECRET_KEY>>");

SessionCreateParams params =

SessionCreateParams.builder()

.setCustomer("{{CUSTOMER_ID}}")

.addLineItem(

SessionCreateParams.LineItem.builder()

.setPriceData(

SessionCreateParams.LineItem.PriceData.builder()

.setCurrency("usd")

.setProductData(

SessionCreateParams.LineItem.PriceData.ProductData.builder()

.setName("T-shirt")

.build()

)

.setUnitAmount(2000L)

.build()

)

.setQuantity(1L)

.build()

)

.setMode(SessionCreateParams.Mode.PAYMENT)

.setSuccessUrl("https://example.com/success.html")

.setCancelUrl("https://example.com/cancel.html")

.setSavedPaymentMethodOptions(

SessionCreateParams.SavedPaymentMethodOptions.builder().build()

)

.putExtraParam("saved_payment_method_options[payment_method_remove]", "enabled")

.build();

// For SDK versions 29.4.0 or lower, remove '.v1()' from the following line.

Session session = client.v1().checkout().sessions().create(params);

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

const stripe = require('stripe')('<<YOUR_SECRET_KEY>>');

const session = await stripe.checkout.sessions.create({

customer: '{{CUSTOMER_ID}}',

line_items: [

{

price_data: {

currency: 'usd',

product_data: {

name: 'T-shirt',

},

unit_amount: 2000,

},

quantity: 1,

},

],

mode: 'payment',

success_url: 'https://example.com/success.html',

cancel_url: 'https://example.com/cancel.html',

saved_payment_method_options: {

payment_method_remove: 'enabled',

},

});

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

sc := stripe.NewClient("<<YOUR_SECRET_KEY>>")

params := &stripe.CheckoutSessionCreateParams{

Customer: stripe.String("{{CUSTOMER_ID}}"),

LineItems: []*stripe.CheckoutSessionCreateLineItemParams{

&stripe.CheckoutSessionCreateLineItemParams{

PriceData: &stripe.CheckoutSessionCreateLineItemPriceDataParams{

Currency: stripe.String(stripe.CurrencyUSD),

ProductData: &stripe.CheckoutSessionCreateLineItemPriceDataProductDataParams{

Name: stripe.String("T-shirt"),

},

UnitAmount: stripe.Int64(2000),

},

Quantity: stripe.Int64(1),

},

},

Mode: stripe.String(stripe.CheckoutSessionModePayment),

SuccessURL: stripe.String("https://example.com/success.html"),

CancelURL: stripe.String("https://example.com/cancel.html"),

SavedPaymentMethodOptions: &stripe.CheckoutSessionCreateSavedPaymentMethodOptionsParams{},

}

params.AddExtra("saved_payment_method_options[payment_method_remove]", "enabled")

result, err := sc.V1CheckoutSessions.Create(context.TODO(), params)

// Set your secret key. Remember to switch to your live secret key in production.

// See your keys here: https://dashboard.stripe.com/apikeys

var options = new Stripe.Checkout.SessionCreateOptions

{

Customer = "{{CUSTOMER_ID}}",

LineItems = new List<Stripe.Checkout.SessionLineItemOptions>

{

new Stripe.Checkout.SessionLineItemOptions

{

PriceData = new Stripe.Checkout.SessionLineItemPriceDataOptions

{

Currency = "usd",

ProductData = new Stripe.Checkout.SessionLineItemPriceDataProductDataOptions

{

Name = "T-shirt",

},

UnitAmount = 2000,

},

Quantity = 1,

},

},

Mode = "payment",

SuccessUrl = "https://example.com/success.html",

CancelUrl = "https://example.com/cancel.html",

SavedPaymentMethodOptions = new Stripe.Checkout.SessionSavedPaymentMethodOptionsOptions

{

PaymentMethodRemove = "enabled",

},

};

var client = new StripeClient("<<YOUR_SECRET_KEY>>");

var service = client.V1.Checkout.Sessions;

Stripe.Checkout.Session session = service.Create(options);

The customer can’t remove a payment method if it’s tied to an active subscription and the customer doesn’t have a default payment method saved for invoice and subscription payments.

Optional: Separate authorization and capture [Server-side]

Stripe supports two-step card payments so you can first authorize a card, then capture funds later. When Stripe authorizes a payment, the card issuer guarantees the funds and places a hold for the payment amount on the customer’s card. You then have a certain amount of time to capture the funds, depending on the card). If you don’t capture the payment before the authorization expires, the payment is cancelled and the issuer releases the held funds.

Separating authorization and capture is useful if you need to take additional actions between confirming that a customer is able to pay and collecting their payment. For example, if you’re selling stock-limited items, you may need to confirm that an item purchased by your customer using Checkout is still available before capturing their payment and fulfilling the purchase. Accomplish this using the following workflow:

- Confirm that Stripe authorized the customer’s payment method.

- Consult your inventory management system to confirm that the item is still available.

- Update your inventory management system to indicate that a customer has purchased the item.

- Capture the customer’s payment.

- Inform your customer whether their purchase was successful on your confirmation page.

To indicate that you want to separate authorization and capture, you must set the value of payment_intent_data.capture_method to manual when creating the Checkout Session. This instructs Stripe to only authorize the amount on the customer’s card.

curl https://api.stripe.com/v1/checkout/sessions \

-u "<<YOUR_SECRET_KEY>>:" \

-d "line_items[0][price]"={{PRICE_ID}} \

-d "line_items[0][quantity]"=1 \

-d mode=payment \

-d "payment_intent_data[capture_method]"=manual \

--data-urlencode success_url="https://example.com/success.html" \

--data-urlencode cancel_url="https://example.com/cancel.html"

stripe checkout sessions create \

-d "line_items[0][price]"={{PRICE_ID}} \

-d "line_items[0][quantity]"=1 \

--mode=payment \

-d "payment_intent_data[capture_method]"=manual \

--success-url="https://example.com/success.html" \

--cancel-url="https://example.com/cancel.html"

# Set your secret key. Remember to switch to your live secret key in production.

# See your keys here: https://dashboard.stripe.com/apikeys

client = Stripe::StripeClient.new("<<YOUR_SECRET_KEY>>")

session = client.v1.checkout.sessions.create({

line_items: [

{

price: '{{PRICE_ID}}',

quantity: 1,

},

],

mode: 'payment',

payment_intent_data: {capture_method: 'manual'},

success_url: 'https://example.com/success.html',

cancel_url: 'https://example.com/cancel.html',

})

# Set your secret key. Remember to switch to your live secret key in production.